The goal of attracting and maintaining quality banking and financial services clients has never been more challenging.

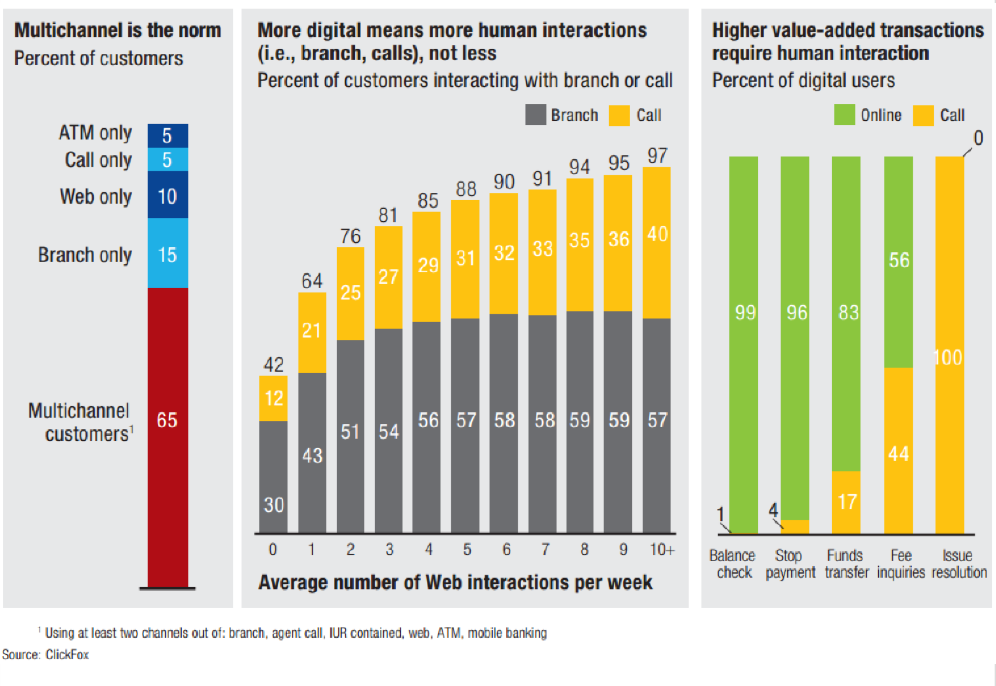

Competitive and regulatory pressures continue to complicate the marketing landscape. Effectively managing customer interactions across multiple channels is the new normal for successful financial institutions.

Ultimately, these efforts need to attract qualified customers, deepen existing customer relationships through proactive cross-selling of relevant products, and most important, provide timely and personalized customer interactions to minimize attrition.

How do you stand out in today’s fiercely competitive retail banking market?

The answer is by identifying, engaging, and cross-selling the right customers, not by flooding existing customers with countless email offers or with static direct mail campaigns like your competition. Data is the currency of customer insight. As a result financial institutions must refine data collection, preserve customers’ data privacy and digital trust, support data-driven banking innovation, and develop predictive analytics capabilities.

Are you leveraging data to the fullest extent possible?

CE Strategy supports internal marketing teams and agencies by using more than traditional financial data to improve customer targeting and analysis of campaign performance. The incorporation of behavioral and life-stage data increases the probability of reaching the right audience with the right offer, at the right time, while reducing waste.

We understand retail banking and multichannel marketing, along with how to turn data and metrics into analytics that deliver insights. These insights are then used to inform effective marketing strategies. By combining our unique understanding of marketing, data, and banking, we assist financial institutions in meeting their goals for growth and retention. Let us help you build demand by being more strategic and data-driven, and establishing segmentation for tailored cross-selling opportunities.

By partnering with us, you tap into: